SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No.__)

|

Filed by the Registrant |

|

☒ |

|

Filed by a Party other than the Registrant |

|

☐ |

Check the appropriate box:

|

☐ |

|

Preliminary Proxy Statement |

|

☐ |

|

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

|

Definitive Proxy Statement |

|

☐ |

|

Definitive Additional Materials |

|

☐ |

|

Soliciting Material Pursuant to § 240.14a-12 |

Atara Biotherapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1. |

Title of each class of securities to which transaction applies: |

|

|

2. |

Aggregate number of securities to which transaction applies: |

|

|

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4. |

Proposed maximum aggregate value of transaction: |

|

|

5. |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1. |

Amount Previously Paid: |

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

3. |

Filing Party: |

|

|

4. |

Date Filed: |

ATARA BIOTHERAPEUTICS, INC.

611 Gateway Blvd., Suite 900

South San Francisco, CA 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 8, 2021

Dear Stockholder:

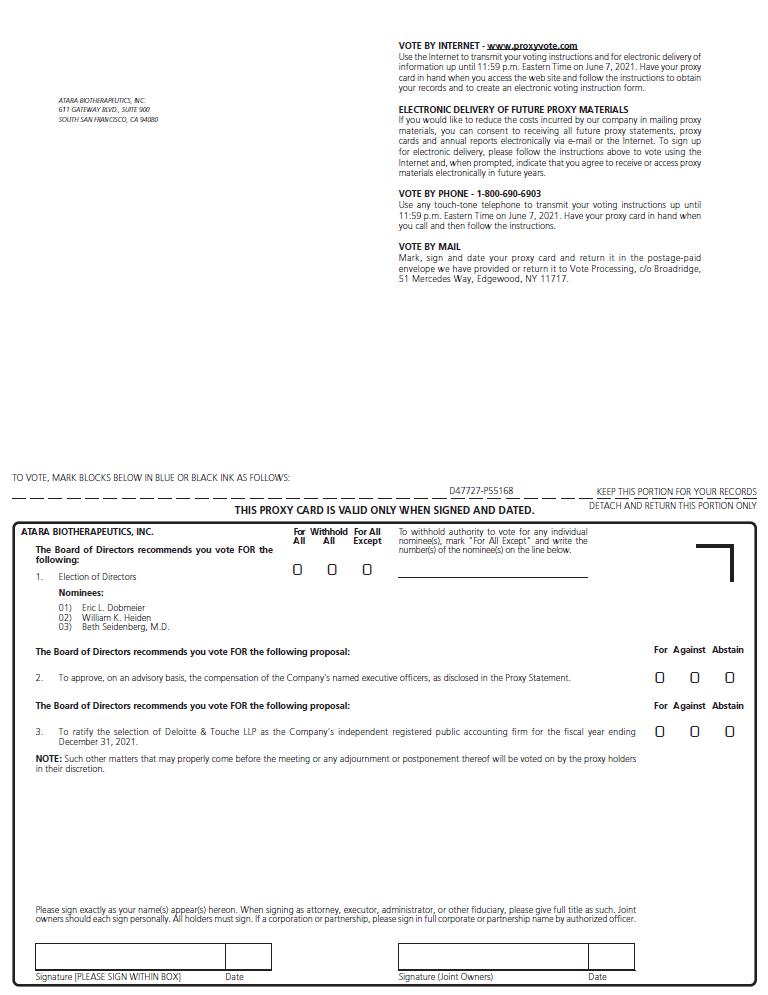

You are cordially invited to attend the Annual Meeting of Stockholders of Atara Biotherapeutics, Inc., a Delaware corporation. The meeting will be held on June 8, 2021 at 9:00 a.m. local time at our office located at 2430 Conejo Spectrum Street, Thousand Oaks, CA 91320 for the following purposes:

|

1. |

To elect our three nominees for director named in the accompanying Proxy Statement to hold office until the 2024 Annual Meeting of Stockholders; |

|

2. |

To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Proxy Statement accompanying this notice; |

|

3. |

To ratify the selection by the Audit Committee of our Board of Directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and |

|

4. |

To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. The record date for the Annual Meeting is April 15, 2021. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

We continue to monitor developments regarding the coronavirus (COVID-19) pandemic. In the interest of the health and well-being of our stockholders, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we make this change, we will announce the decision to do so in advance and provide details on how to participate at investors.atarabio.com.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 8, 2021 at 9:00 a.m. local time at 2430 Conejo Spectrum Street, Thousand Oaks, CA 91320. The Proxy Statement and Atara’s Annual Report on Form 10-K for the fiscal year 2020 are available electronically at www.proxyvote.com.

|

By Order of the Board of Directors

/s/ Pascal Touchon

Pascal Touchon, D.V.M.

President and Chief Executive Officer

South San Francisco, California

April 22, 2021

|

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the proxy card mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

|

TABLE OF CONTENTS

ATARA BIOTHERAPEUTICS, INC.

611 Gateway Blvd., Suite 900, South San Francisco, CA 94080

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because our Board of Directors (the “Board”) is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), including any votes related to adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. In this Proxy Statement, “we”, “us”, “our”, “Company” and “Atara” refer to Atara Biotherapeutics, Inc.

We intend to mail the Notice on or about April 23, 2021 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The meeting will be held on June 8, 2021 at 9:00 a.m. local time at our offices at 2430 Conejo Spectrum Street, Thousand Oaks, CA 91320. Information on how to vote in person at the annual meeting is discussed below. We continue to monitor developments regarding the COVID-19 pandemic. In the interest of the health and well-being of our stockholders, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we make this change, we will announce the decision to do so in advance and provide details on how to participate at investors.atarabio.com.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 15, 2021 will be entitled to vote at the Annual Meeting. On this record date, there were 84,076,737 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 15, 2021 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), then you are a stockholder of record for purposes of the Annual Meeting. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return a proxy card or vote by proxy, over the telephone or on the internet as instructed below to ensure your vote is counted.

1

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Organization

If on April 15, 2021 your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct the organization holding your account regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from this organization.

What am I voting on?

There are three matters scheduled for a vote:

|

|

• |

Election of three directors named in this Proxy Statement to hold office until the 2024 Annual Meeting of Stockholders; |

|

|

• |

Advisory approval of the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement in accordance with SEC rules; and |

|

|

• |

Ratification of selection by the Audit Committee of our Board of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

What if another matter is properly brought before the Annual Meeting?

We currently know of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the proxyholders named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may either vote “For” or “Against” or abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already submitted a proxy.

|

|

• |

To vote in person, attend the Annual Meeting, at which we will give you a ballot upon request. |

|

|

• |

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the Company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m. Eastern time on June 7, 2021 to be counted. |

|

|

• |

To vote through the internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the Company number and control number from the Notice. Your internet vote must be received by 11:59 p.m. Eastern time on June 7, 2021 to be counted. |

|

|

• |

To vote by mail using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card before the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares as you direct. |

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other similar organization, you should receive a Notice containing voting instructions from that organization rather than from Atara. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other similar organization. Follow the instructions from your broker, bank or other similar organization included with the proxy materials, or contact your broker, bank or other similar organization to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 15, 2021.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other similar organization how to vote your shares, the question of whether your nominee will still be able to vote your shares depends on whether the particular proposal is deemed to be a “routine” matter under the rules of various securities exchanges. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the applicable rules, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if supported by management. Accordingly, your nominee may not vote your shares on Proposals 1 and 2 without your instructions, but may vote your shares on Proposal 3, even in the absence of your instruction.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each of the nominees for director; “For” the advisory approval of named executive officer compensation; and “For” ratification of selection by the Audit Committee of our Board of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. If any other matter is properly presented at the Annual Meeting, your proxyholder will vote your shares using their best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other similar organizations for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Notices you receive to ensure that all of your shares are voted.

3

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

|

• |

you may submit another properly completed proxy card with a later date; |

|

|

• |

you may grant a subsequent proxy by telephone or through the internet; |

|

|

• |

you may send a timely written notice that you are revoking your proxy to our Secretary at 611 Gateway Blvd., Suite 900, South San Francisco, CA 94080 (such notice will be considered timely if it is received at the indicated address by close of business on the business day immediately preceding the date of the Annual Meeting); or |

|

|

• |

you may attend the Annual Meeting and vote in person. |

Simply attending the Annual Meeting will not, by itself, revoke your proxy. Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other similar organization as a nominee or agent, you should follow the instructions provided by your broker, bank or other similar organization.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 27, 2021 to our Secretary at 611 Gateway Blvd., Suite 900, South San Francisco, CA 94080, and must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); provided, however, that if our 2022 Annual Meeting of Stockholders is held before May 9, 2022 or after July 8, 2022, then the deadline is a reasonable amount of time prior to the date we print and mail the Notice for the 2022 Annual Meeting of Stockholders. If you wish to submit a proposal (including a director nomination) that is not to be included in next year’s proxy materials, the proposal must be received by our Secretary not later than the close of business on March 10, 2022 nor earlier than the close of business on February 8, 2022; provided, however, that if our 2022 Annual Meeting of Stockholders is held before May 9, 2022 or after July 8, 2022, then the proposal must be received no earlier than the close of business on the 120th day prior to such meeting and not later than the close of business on the later of the 90th day prior to such meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other similar organization holding the shares as nominee as to how to vote on matters deemed to be “non-routine,” the nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

4

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

|

Proposal Number |

|

Proposal Description |

|

Vote Required for Approval |

|

Effect of Abstentions |

|

Effect of Broker Non-Votes |

|

1 |

|

Election of directors |

|

Nominees receiving the most “For” votes

|

|

None |

|

None |

|

2 |

|

Advisory approval of the compensation of the Company’s named executive officers |

|

“For” votes from the holders of a majority of shares present in person, present by remote communication, if applicable, or represented by proxy and entitled to vote on the matter

|

|

Against |

|

None |

|

3 |

|

Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 |

|

“For” votes from the holders of a majority of shares present in person, present by remote communication, if applicable, or represented by proxy and entitled to vote on the matter |

|

Against |

|

Not Applicable(1) |

|

(1) |

This proposal is considered to be a “routine” matter under applicable rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under applicable New York Stock Exchange rules to vote your shares on this proposal. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting in person, present by remote communication, if applicable, or represented by proxy. On the record date, there were 84,076,737 shares outstanding and entitled to vote. Thus, the holders of 42,038,369 shares must be present in person, present by remote communication, if applicable, or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5

ELECTION OF DIRECTORS

The Board is divided into three classes. Each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has nine members. There are three directors in the class whose term of office expires in 2021. Each of the nominees listed below is currently a member of our Board who has been recommended for reelection by the Nominating and Corporate Governance Committee and nominated for reelection by the Board. If elected at the Annual Meeting, each of these nominees would serve until the 2024 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is our policy to invite and encourage directors and nominees for director to attend the Annual Meeting. All of our directors attended our 2020 virtual-only Annual Meeting of Stockholders.

Directors are elected by a plurality of the votes of the holders of shares present in person, present by remote communication, if applicable, or represented by proxy and entitled to vote on the election of directors. This means that the three nominees receiving the highest number of affirmative votes, even if less than a majority of the shares outstanding on the record date, will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by the Board. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee and each director whose term will continue after the Annual Meeting.

Nominees for Election for a Three-year Term Expiring at the 2024 Annual Meeting

Eric L. Dobmeier, 52, has served as a member of the Board since March 2015. Mr. Dobmeier has served as President and Chief Executive Officer, and as a member of the board of directors, of Chinook Therapeutics, Inc., a biotechnology company, since April 2019. From January 2018 to June 2018, Mr. Dobmeier was President and Chief Executive Officer of Silverback Therapeutics, Inc., a biotechnology company. Prior to that, he was at Seattle Genetics, Inc., a biotechnology company, from 2002 to 2017, where he held positions of increasing responsibility, most recently as Chief Operating Officer from June 2011 to December 2017. Prior to joining Seattle Genetics, Mr. Dobmeier was an attorney with the law firms of Venture Law Group and Heller Ehrman LLP, where he represented technology companies in connection with public and private financings, mergers and acquisitions and corporate partnering transactions. Mr. Dobmeier formerly served on the board of directors of Stemline Therapeutics, Inc. from 2012 to 2018, Versartis, Inc. from 2017 to 2018 and Adaptive Biotechnologies Corporation from 2016 to 2021. Mr. Dobmeier received a J.D. from the University of California, Berkeley School of Law and an A.B. in History from Princeton University. We believe that Mr. Dobmeier’s legal, business development and operating experience, years of senior management experience at a public biotechnology company and his service as a director of other biopharmaceutical companies provide him with the qualifications and skills to serve as a director of our Company.

William K. Heiden, 61, has served as a member of the Board since November 2015. Mr. Heiden served as the President and Chief Executive Officer, and as a member of the board of directors, of AMAG Pharmaceuticals, Inc., a pharmaceutical company, from May 2012 until April 2020. Prior to joining AMAG, Mr. Heiden served as President and Chief Executive Officer of GTC Biotherapeutics, Inc. (now part of LFB, S.A.), a biotherapeutics company, from June 2010 to May 2012. From September 2004 until December 2008, Mr. Heiden served as President and Chief Executive Officer of Elixir Pharmaceuticals, Inc., a biopharmaceutical company. Prior to joining Elixir Pharmaceuticals, Mr. Heiden served as President and Chief Operating Officer of Praecis Pharmaceuticals Incorporated (which was acquired by GlaxoSmithKline), from 2002 to 2004. From 1987 to 2002, Mr. Heiden progressed through various positions of increasing responsibility at Schering-Plough Corporation (which was acquired by Merck & Co.), including managing a number of businesses in the United States, Europe and Canada. Mr. Heiden holds an M.B.A. from Cornell University’s Johnson Graduate School of Management, a M.I.M. degree from the University of Louvain and a B.A. degree from the University of Florida. We believe that Mr. Heiden’s extensive experience as a pharmaceutical and biotechnology executive provide him with the qualifications and skills to serve as a director of our Company.

Beth Seidenberg, M.D., 64, has served as a member of the Board since our founding in August 2012. Dr. Seidenberg is the managing director of Westlake Village BioPartners, a venture capital firm that focused on life sciences that she founded in September 2018. Dr. Seidenberg is also a General Partner at Kleiner Perkins Caufield & Byers, a venture capital firm, where she has primarily focused on life sciences investing since May 2005. Dr. Seidenberg was previously the Senior Vice President,

6

Head of Global Development and Chief Medical Officer at Amgen, Inc., a biotechnology company. In addition, Dr. Seidenberg was a senior executive in research and development at Bristol Myers Squibb Company, a biopharmaceutical company, and Merck. Dr. Seidenberg received a B.S. from Barnard College and an M.D. from the University of Miami School of Medicine and completed her post-graduate training at The Johns Hopkins University, George Washington University and the National Institutes of Health. Dr. Seidenberg has served on the board of directors of Progyny, Inc., since 2010. Dr. Seidenberg formerly served on the board of directors of TESARO from 2011 to 2018, ARMO BioScience from 2012 to 2018, and Epizyme, Inc. from 2008 to 2019. We believe that Dr. Seidenberg’s extensive experience in the life sciences industry as a senior executive and venture capitalist, as well as her training as a physician, provide her with the qualifications and skills to serve as a director of our Company.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Directors Continuing in Office Until the 2022 Annual Meeting

Roy Baynes, M.D., Ph.D., 66, has served as a member of the Board since September 2018. Dr. Baynes has served as Senior Vice President and Head of Global Clinical Development at Merck Research Laboratories, the research division of Merck and Co., Inc., since December 2013 and as Chief Medical Officer of Merck and Co, a global healthcare company, since July 2016. Prior to his roles at Merck, Dr. Baynes served as Senior Vice President of Oncology, Inflammation and Respiratory Therapeutics at Gilead Sciences, Inc., a biopharmaceutical company, from January 2012 to December 2013. Prior to Gilead, Dr. Baynes held positions of increasing responsibility at Amgen Inc., a biotechnology company, from August 2002 to January 2012, most recently as Vice President of Global Clinical Development and Therapeutic Area Head for Hematology/Oncology. Before joining Amgen, Dr. Baynes was the Charles Martin Professor of Cancer Research at the Barbara Ann Karmanos Cancer Institute, a National Cancer Institute-designated Comprehensive Cancer Center, at Wayne State University. Dr. Baynes serves on the board of directors of Natera, Inc. and Travere Therapeutics, Inc. Dr. Baynes has authored more than 150 publications and is a member or fellow of several international medical societies. Dr. Baynes received his medical degree and doctorate in philosophy from the University of the Witwatersrand in South Africa and completed his medical training in the Department of Hematology and Oncology at Johannesburg Hospital. We believe that Dr. Baynes is qualified to serve on our Board due to his extensive executive experience in the life sciences industry, his leadership and management experience, and his service as a director of other biopharmaceutical companies.

Matthew K. Fust, 56, has served as a member of the Board since March 2014. Mr. Fust is a board member and advisor to life sciences companies. Mr. Fust has served on the board of directors of Crinetics Pharmaceuticals, Inc. since February 2018, and Ultragenyx Pharmaceutical, Inc. since January 2014. Mr. Fust formerly served of the board of directors of Sunesis Pharmaceuticals, Inc. from 2005 to 2017, MacroGenics, Inc. from March 2014 through May 2020, and Dermira, Inc. from April 2014 through February 2020. Mr. Fust was previously Executive Vice President and Chief Financial Officer of Onyx Pharmaceuticals, Inc., a biopharmaceutical company, from January 2009 through its acquisition by Amgen in October 2013. Mr. Fust continued as an employee of Amgen until January 2014. From May 2003 to December 2008, Mr. Fust served as Chief Financial Officer at Jazz Pharmaceuticals, Inc., a specialty pharmaceutical company. From 2002 to 2003, Mr. Fust served as Chief Financial Officer at Perlegen Sciences, a biopharmaceutical company. Previously, he was Senior Vice President and Chief Financial Officer at ALZA Corporation, a pharmaceutical company, where he was an executive from 1996 until 2002. From 1991 until 1996, Mr. Fust was a manager in the healthcare strategy practice at Andersen Consulting. Mr. Fust received a B.A. from the University of Minnesota and an M.B.A. from the Stanford Graduate School of Business. We believe that Mr. Fust is qualified to serve on our Board due to his extensive experience as a chief financial officer in the life sciences industry, his leadership and management experience, and his service as a director of other biopharmaceutical companies.

Ronald C. Renaud, Jr., 52, has served as a member of the Board since April 2020. Mr. Renaud serves as chief executive officer of Translate Bio, Inc., where he also serves as a member of the board of directors, positions he has held since November 2014. Formerly, Mr. Renaud served as president and chief executive officer of Idenix Pharmaceuticals, Inc., a biopharmaceutical company, from 2010 until Idenix was acquired by Merck & Co., Inc. in August 2014. He was previously chief financial officer and chief business officer of Idenix from 2007 until his appointment as chief executive officer. Prior to joining Idenix, he served as senior vice president and chief financial officer of Keryx Biopharmaceuticals, Inc. Mr. Renaud served as a member of the boards of directors of Akebia Therapeutics, Inc. from September 2014 to December 2018, PTC Therapeutics from June 2014 to June 2017 and Chimerix, Inc. from December 2014 to June 2020. Since March 2018, he has served on the board of directors of Ikena Oncology, Inc., and currently serves as Chairman. Mr. Renaud received a B.A. from St. Anselm College and an M.B.A. from the Marshall School of Business at the University of Southern California. We believe that Mr. Renaud is qualified to serve on our Board because of his service on the boards of other private and public life sciences companies, his leadership and management experience and his extensive knowledge of our industry.

7

Directors Continuing in Office Until the 2023 Annual Meeting

Pascal Touchon, D.V.M., 58, has served as our President and Chief Executive Officer and a member of the Board since June 2019. Prior to joining the Company, Dr. Touchon has served in roles of increasing responsibility at Novartis Oncology, a business unit of Novartis International AG, a global pharmaceutical company, since August 2015, most recently as Global Head Cell & Gene Therapies Oncology and a member of the Oncology Executive Committee. Previously, Dr. Touchon was Global Head Strategy, Business Development & Licensing, Oncology and a member of the Oncology Executive Committee. Prior to joining Novartis, Dr. Touchon spent nearly 30 years in the pharmaceutical industry in various companies, countries and leadership roles, including with Servier SAS, a privately owned French pharmaceutical company, as Senior Executive Vice President, member of the company Executive Committee and Head of Business Development and Licensing. Dr. Touchon holds a Doctorate in Veterinary Medicine from Paul Sabatier University (Toulouse, France), a Diplôme d’Etudes Supérieures Spécialisées (DESS) in Management from Institut d’Administration des Entreprises (Toulouse, France) and an MBA from INSEAD (Fontainebleau, France). We believe that Dr. Touchon is qualified to serve on our Board due to his role as our President and Chief Executive Officer, his extensive experience in the pharmaceuticals industry and his leadership and management experience.

Carol Gallagher, Pharm.D., 56, has served as a member of the Board since January 2013. Since October 2014, Dr. Gallagher served as a partner with New Enterprise Associates, a venture capital firm, and she now serves as a venture partner, a part-time role. Prior to joining New Enterprise Associates, Dr. Gallagher served as a venture partner with Frazier Healthcare, a venture capital firm, from October 2013 to September 2014. Dr. Gallagher served as the President and Chief Executive Officer of Calistoga Pharmaceuticals, a biopharmaceutical company, from 2008 to 2011, when the company was acquired by Gilead Sciences. From 2007 to 2008, Dr. Gallagher was the President and Chief Executive Officer of Metastatix, Inc., a biopharmaceutical company. Prior to that time starting in 1989, she served in various roles at pharmaceutical companies Eli Lilly, Amgen, Agouron Pharmaceuticals, Pfizer, Biogen Idec Pharmaceuticals, CancerVax and Anadys Pharmaceuticals. In addition to our Board, Dr. Gallagher serves as a director at the following public companies: Millendo Therapeutics, Inc., a biotechnology company, where she has served as a member of the board of directors since 2012; Turning Point Therapeutics, Inc., a biotechnology company, where she has served since August 2019, and Frazier Life Sciences Acquisition Corp, a special purpose acquisition company, since October 2020. She previously served on the boards of directors at Anaptys Bio Inc. from 2011 until 2018 and Metacrine, Inc. from 2018 until April 2021. Dr. Gallagher attended Vanderbilt University and received B.S. and Doctor of Pharmacy degrees from the University of Kentucky. We believe that Dr. Gallagher is qualified to serve on our Board due to her extensive experience in the pharmaceuticals industry, her leadership and management experience, and her service as a director of other biopharmaceutical companies.

Maria Grazia Roncarolo, M.D., 66, has served as a member of the Board since May 2020. Dr. Roncarolo serves as the Professor of Pediatrics and Medicine at Stanford University, and Codirector of the Stanford Institute for Stem Cell Biology and Regenerative Medicine, positions she has held since June 2014. From 2007 to 2014 Dr. Roncarolo served as Professor of Pediatrics at the School of Medicine and Surgery, San Raffaele Vita-Salute University, in Milan. From 2008 to 2013, Dr. Roncarolo served as the Scientific Director of the San Raffaele Scientific Institute in Milan. From 2000 to 2007, she served as the Director of the San Raffaele Telethon Institute for Gene Therapy in Milan. Prior to joining San Raffaele, she was a scientific staff member of the DNAX Research Institute of Molecular and Cellular Biology. In 2005, Dr. Roncarolo was elected member of the Academia Europea of Sciences. In 2000, she was awarded the honor of Ufficiale dell’Ordine “Al Merito della Repubblica Italiana” for scientific merits. Leading up to that, Dr. Roncarolo actively collaborated in the development of research programs for industry and biotechnology companies, including service as Co-Chair of the Scientific Advisory Board of Glaxo Smith Kline for cell and gene therapy from 2016 to 2018, as Consultant for Novartis Pharmaceutical in the areas of immunology, transplantation and gene transfer from 1997 to 2002, as a founding member of the scientific advisory board for Kinetix Pharmaceutical from 1997 to 2000. Dr. Roncarolo has served on the board of directors of Cosmo Pharmaceuticals NV since April 2012. Dr. Roncarolo received her medical degree from the University of Torino. We believe that Dr. Roncarolo is qualified to serve on our Board due to her deep industry knowledge and experience leading research efforts in the field.

8

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

Generally, under the listing requirements and rules of The Nasdaq Stock Market (“Nasdaq”), independent directors must comprise a majority of a listed company’s board of directors. The Board has undertaken a review of its composition, the composition of its committees and the independence of each director. The Board has determined that, other than Dr. Touchon, by virtue of his position as President and Chief Executive Officer, none of our directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined under the listing requirements and rules of Nasdaq. Accordingly, a majority of the members of the Board is independent, as required under applicable Nasdaq rules. In making this determination, the Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances the Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Leadership Structure

Mr. Renaud, an independent director, currently serves as the chair of the Board. As chair of the Board, Mr. Renaud establishes the agenda for regular Board meetings, presides over Board meetings, presides over periodic meetings of the Board’s independent directors, serves as a liaison between our Chief Executive Officer and the independent directors and performs such additional duties as the Board may otherwise determine and delegate. Accordingly, the chair of the Board has substantial ability to shape the work of the Board. We believe that separation of the positions of the chair of the Board and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, we believe that having an independent chair of the Board creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, we believe having an independent chair of the Board can enhance the effectiveness of the Board as a whole.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. The Audit Committee has the responsibility to consider and discuss our major financial and cybersecurity risk exposures and the steps management has taken to monitor and control these exposures, including guidelines and policies designed to mitigate risks identified. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. The Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. The Audit Committee meets with management at least annually to review corporate risk management and plans to mitigate risks, including insurance coverage. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. The Board has delegated to the chair of the Board the responsibility of coordinating between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

9

Meetings of the Board of Directors

The Board met seven times during 2020. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which they served held during the portion of the last fiscal year for which they were a director or committee member. In addition, in 2020, our non-employee directors met four times in regularly scheduled executive sessions at which only non-employee directors were present. Mr. Renaud served as chair for Board meetings and presided over the executive sessions while he was a member of the Board. Prior to Mr. Renaud joining the Board, Dr. Gallagher served as our lead independent director and presided over the executive sessions.

Information Regarding Committees of the Board of Directors

The Board has four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, and a Research and Development Committee. The following table provides membership and meeting information for each of the Board committees in 2020:

|

Name |

|

Audit |

|

Compensation |

|

Nominating and Corporate Governance |

Research and Development |

|

Pascal Touchon, D.V.M. |

|

|

|

|

|

|

X* |

|

Roy Baynes, M.D., Ph.D. |

|

|

|

X |

|

|

X |

|

Eric L. Dobmeier |

|

X |

|

X* |

|

|

|

|

Matthew K. Fust |

|

X* |

|

|

|

X |

|

|

Carol Gallagher, Pharm.D. |

|

|

|

X |

|

X |

|

|

William K. Heiden |

|

X |

|

|

|

|

|

|

Beth Seidenberg, M.D. |

|

|

|

|

|

X* |

X |

|

Ronald C. Renaud Jr. (1) |

|

|

|

|

|

|

|

|

Maria Grazia Roncarolo, M.D. (2) |

|

|

|

|

|

|

X |

|

Total meetings in 2020 |

|

5 |

|

5 |

|

1 |

2 |

|

* |

Committee Chair. |

|

(1) |

In April 2020, Mr. Renaud joined the Board as chair of the Board. |

|

(2) |

In May 2020, Dr. Roncarolo joined the Board. |

Audit Committee

The Board has determined that each member of the Audit Committee is independent under Nasdaq listing standards and Rule 10A-3(b)(1) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has also determined that Mr. Fust is an “audit committee financial expert” within the meaning of SEC regulations. Each member of the Audit Committee has the requisite financial expertise required under the applicable requirements of Nasdaq. In arriving at this determination, the Board examined each Audit Committee member’s scope of experience and the nature of their employment in the corporate finance sector. The primary functions of this committee include:

|

|

• |

reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services; |

|

|

• |

evaluating the performance of our independent registered public accounting firm and deciding whether to retain its services; |

|

|

• |

monitoring the rotation of partners on the engagement team of our independent registered public accounting firm; |

|

|

• |

reviewing our annual and quarterly financial statements and reports and discussing the statements and reports with our independent registered public accounting firm and management, including a review of disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

|

|

• |

considering and approving or disapproving of all related party transactions; |

|

|

• |

reviewing, with our independent registered public accounting firm and management, significant issues that may arise regarding accounting principles and financial statement presentation, as well as matters concerning the scope, adequacy and effectiveness of our financial controls; |

|

|

• |

assessing our financial risks and management of those risks; |

10

|

|

|

|

• |

establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting or auditing matters; and |

|

|

• |

reviewing and evaluating, at least annually, the performance of the Audit Committee and the adequacy of its charter. |

The Audit Committee has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has adopted a written Audit Committee charter that is available to stockholders on our website at http://investors.atarabio.com/corporate-governance.

Report of the Audit Committee of the Board of Directors1

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2020 with our management. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Matthew K. Fust

Eric L. Dobmeier

William Heiden

Compensation Committee

The Board has determined that each member of the Compensation Committee is independent under Nasdaq listing standards and Rule 10c-1 promulgated under the Exchange Act, and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The primary functions of this committee include:

|

|

• |

determining the compensation and other terms of employment of our Chief Executive Officer and other executive officers and reviewing and approving corporate performance goals and objectives relevant to such compensation; |

|

|

• |

determining the compensation of our non-employee directors; |

|

|

• |

evaluating, adopting and administering the equity incentive plans, compensation plans and similar programs advisable for Atara, as well as reviewing and recommending to the Board the adoption, modification or termination of our plans and programs; |

|

|

• |

establishing policies with respect to equity compensation arrangements; |

|

|

• |

reviewing with management any required disclosures under the caption “Compensation Discussion and Analysis” and recommending to the Board its inclusion in our periodic reports to be filed with the SEC; |

|

|

• |

periodically review with the Chief Executive Officer the plans for succession for the Company’s executive officers; and |

|

|

• |

reviewing and evaluating, at least annually, the performance of the Compensation Committee and the adequacy of its charter. |

|

|

1 |

The material in this report is not “soliciting material,” is being furnished and shall not be deemed “filed” with the Commission and is not to be incorporated by reference in any filing of Atara under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

11

The Compensation Committee has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has adopted a written Compensation Committee charter that is available to stockholders on our website at http://investors.atarabio.com/corporate-governance.

Compensation Committee Processes and Procedures

The Compensation Committee met five times during 2020. The agenda for each meeting is usually developed by our Chief Executive Officer, Chief People Officer and General Counsel in consultation with the Chair of the Compensation Committee and our outside compensation consultants, if applicable. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer does not and will not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all of our books, records, facilities and personnel. In addition, under the charter, the Compensation Committee has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other advisor to the Compensation Committee (other than in-house legal counsel and certain other types of advisors), only after assessing their independence in accordance with, and to the extent required by, applicable law and the listing requirements of Nasdaq; however, there is no requirement that any advisor be independent.

During 2020, the Compensation Committee engaged the Radford advisory team of the Rewards Solution practice at Aon (“Radford”) as independent compensation consultant. After considering all of the factors required by applicable Nasdaq rules, the Compensation Committee was satisfied with Radford’s independence and requested that Radford evaluate and help us refine our employee and non-employee director compensation strategies and practices. As part of its engagement, Radford was requested by the Compensation Committee to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for that group. With respect to the compensation of the Chief Executive Officer, Radford developed recommendations that were presented to the Compensation Committee for its consideration. Following an active dialogue with Radford, the Compensation Committee considered the recommendations in addition to corporate performance and approved the recommendations subject to certain modifications deemed appropriate by the Compensation Committee. With respect to the executive officers, the Chief Executive Officer in consultation with Radford developed recommendations that were presented to the Compensation Committee for its consideration. Following an active dialogue with the Chief Executive Officer and with Radford, the Compensation Committee considered the recommendations in addition to corporate and individual performance and approved the recommendations subject to certain modifications deemed appropriate by the Compensation Committee.

Historically, the Compensation Committee has made most of the significant adjustments to annual compensation and determined bonus and equity awards at one or more meetings held during the first quarter of the year. The Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation strategy, potential modifications to that strategy, risks created by that strategy and new trends, retention concerns and plans or approaches to compensation, at various meetings throughout the year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee with feedback from the Board as well as the executives, which determines any adjustments to Chief Executive Officer’s compensation as well as awards to be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials that it deems relevant. These materials may include financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, company stock performance data, analyses of historical executive compensation levels and current compensation levels across our Company and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation paid at the comparative group of companies (with such group of companies developed by Radford and agreed upon by the Compensation Committee).

12

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Board or the Compensation Committee.

Report of the Compensation Committee of the Board of Directors2

The Compensation Committee, consisting solely of independent directors, has reviewed and discussed with management the Compensation Discussion and Analysis (“CD&A”) contained in this Proxy Statement. Based on this review and discussion, the Compensation Committee has recommended to the Board that the CD&A be included in this Proxy Statement and incorporated into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Roy Baynes

Carol S. Gallagher

Nominating and Corporate Governance Committee

The Board has determined that each member of the Nominating and Corporate Governance Committee is independent under the Nasdaq listing standards. The primary functions of this committee include:

|

|

• |

periodically reviewing and evaluating director performance on the Board and its committees, and recommending to the Board and management areas for improvement; |

|

|

• |

interviewing, evaluating, nominating and recommending individuals for membership on the Board and its committees; |

|

|

• |

reviewing and recommending to the Board any amendments to our corporate governance policies; and |

|

|

• |

reviewing and assessing, at least annually, the performance of the Nominating and Corporate Governance Committee and the adequacy of its charter. |

The Nominating and Corporate Governance Committee has authority to engage advisors or consultants (including legal counsel and search firms), as it deems appropriate to carry out its responsibilities. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on our website at http://investors.atarabio.com/corporate-governance.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. In evaluating director nominee candidates, the Nominating and Corporate Governance Committee typically also considers factors such as: possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to our affairs, demonstrated excellence in their field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders and other factors is deems appropriate given then-current needs of the Board and Atara, to maintain a balance of knowledge, experience and capability. However, the Nominating and Corporate Governance Committee retains the right to modify the above qualifications from time to time.

The Board believes that diversity of viewpoints, background, experience and other characteristics, such as race, gender, ethnicity, sexual orientation, culture and nationality, are an important part of its makeup, and the Nominating and Corporate Governance Committee and the Board actively seek these characteristics in identifying director candidates.

|

|

2 |

The material in this report is not “soliciting material,” is being furnished and shall not be deemed “filed” with the Commission and is not to be incorporated by reference in any filing of Atara under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

13

Candidates for director nominees are reviewed in the context of the current composition of the Board, our operating requirements, Nasdaq listing standards, applicable law and regulations and the long-term interests of stockholders. The Nominating and Corporate Governance Committee also determines whether a nominee is independent for Nasdaq purposes based upon Nasdaq listing standards, SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of potential director candidates. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and ultimately recommend director nominees to the Board.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to Atara during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 611 Gateway Blvd., Suite 900, South San Francisco, CA 94080 not less than six months prior to any meeting at which directors are to be elected. Submissions must include the full name of the proposed nominee, a description of the proposed nominee’s business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of our common stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Research and Development Committee

The Research and Development Committee provides advice and support to the Company in relation to the Company’s research and development activities and strategy. The primary function of this committee is to confer with the Chief Executive Officer and the Company’s research and development leadership team regarding:

|

|

• |

the Company’s research and development activities and strategy; |

|

|

• |

significant emerging regulatory, research, scientific, and medical trends and developments relevant to the Company’s research and development activities and strategy, including their potential impact on the Company’s programs or plans; |

|

|

• |

infrastructure and resources made available by the Company for its research and development activities and clinical trial programs; and |

|

|

• |

research and development, scientific, medical and intellectual property aspects of any proposed material transactions such as significant investments, acquisitions and licenses. |

The Board has adopted a written Research and Development Committee charter that is available to stockholders on our website at http://investors.atarabio.com/corporate-governance.

Stockholder Communications with the Board

The Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. This information is available on our website at http://investors.atarabio.com/corporate-governance. Any interested person may also communicate directly with the chair of the Board or the independent or non-employee directors. Persons interested in communicating directly with the independent or non-employee directors regarding their concerns or issues are referred to the procedures for such communications on our website at http://investors.atarabio.com/contact-board.

14

Code of Conduct

The Board has adopted a code of conduct that applies to all of our corporate employees, officers and directors, including those officers and employees responsible for financial reporting. Our code of conduct is available on our website at http://investors.atarabio.com/corporate-governance. We intend to disclose any amendments to this policy, or any waivers of its requirements, on our website or in public filings to the extent required by applicable SEC rules or exchange requirements.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to assure that the Board will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Corporate Governance Guidelines also formalize the Board’s belief that a diversity of viewpoints, background, experience and other characteristics, such as race, gender, ethnicity, sexual orientation, culture and nationality, are an important part of its makeup, and that it actively seeks these characteristics in identifying director candidates.

Our Corporate Governance Guidelines are available on our website at http://investors.atarabio.com/corporate-governance.

Stock Ownership Guidelines

In December 2020, the Board approved Stock Ownership Guidelines for our directors and named executive officers to further align their financial interests with those of our stockholders, as well as promote sound corporate governance. For a detailed description of our Stock Ownership Guidelines see “Other Compensation Policies and Guidelines – Stock Ownership Guidelines” below.

Hedging Policy

The Company’s policies prohibit all employees (including executive officers) and directors from engaging in short sales, transactions in put or call options, hedging transactions or similar inherently speculative transactions with respect to our stock at any time.

Clawback Policy

In December 2020, the Board adopted an Incentive Compensation Recoupment Policy (“Clawback Policy”). For a detailed description of our Clawback Policy see “Other Compensation Policies and Guidelines – Clawback Policy” below.

Environmental, Social and Governance

Our approach to Environmental, Social and Governance (“ESG”) factors is consistent with our mission and our corporate values. We are committed to conducting our business in a safe and environmentally sustainable manner that promotes the health of our employees, our customers, our community and the environment.

Governance

We are committed to good corporate governance and to conduct our business in an ethical manner. We have adopted numerous policies and guidelines to facilitate legal and ethical conduct and to further align the interests of our employees and directors with our stockholders and other key stakeholders, including the patients we serve. For a detailed description of several of these policies and guidelines, see “Information Regarding the Board of Directors and Corporate Governance” above.

Environmental Sustainability

We are committed to operating our facilities in an environmentally responsible way to reduce environmental impacts and protect our people, our business, the environment and the communities where we operate. In light of the potential impact our business may have on the environment, we have set goals and adopted a number of internal policies and management systems designed to eliminate, reduce, or substitute hazardous materials and waste and reduce water and energy consumption. For

15

example, our Thousand Oaks, CA manufacturing facility: (i) is LEED certified (LEED V.3 BD+C Certified Core & Shell); (ii) is California Energy Commission Title 24 compliant for building and interior improvements; and (iii) has equipment and systems in place designed to ensure operational and energy efficiency.

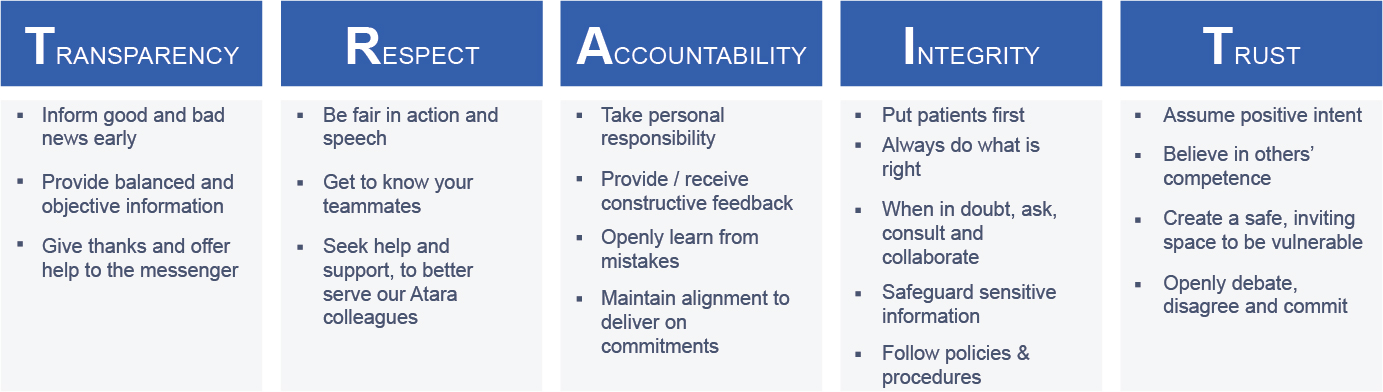

Supplier Code of Conduct

We are committed to maintaining the highest standards of legal and ethical conduct and to reflect our corporate values of transparency, respect, accountability, integrity and trust (“TRAIT”). We expect our suppliers to demonstrate a similar commitment to legal and ethical business practices. In 2020, we developed and implemented the Atara Supplier Code of Conduct to convey our minimum expectations for our suppliers, and their respective subcontracts and suppliers, to: (i) operate in full compliance with all laws, rules and regulations; (ii) conduct business ethically and act with integrity; (iii) uphold the human rights of workers and to treat workers with dignity and respect; (iv) provide a safe and healthy working environment; and (v) operate in an environmentally responsible and efficient manner.

COVID-19 Response

During the COVID-19 pandemic, to support the health, safety and engagement of our staff and to ensure business continuity, we enacted numerous safeguards, such as: (i) reduction of on-site staff presence to essential activities and implemented remote work for non-essential activities; (ii) established engineering controls and business processes to reduce risk of on-site transition and preventing “super-spreader” events through physical distancing, enhanced cleaning and hygiene, and providing our staff with personal protective equipment; (iii) created an on-site COVID-19 monitoring program and an at-home testing program; and (iv) designed and executed a rapid and transparent communication and education strategy to ensure our staff has all relevant scientific data at the local, regional and national level.

In February 2020, we established a COVID-19 Rapid Response Team (“RRT”), sponsored by two Company executives, to assess and address business risks associated with the COVID-19 pandemic. The RRT created clear and regular communications channels, ensured enhanced cleaning and sanitation at our facilities, assessed the impact to our operations, donors, vendors, and clinical trial sites globally, as well as monitored peer companies’ approaches to apply best practices to our processes and decisions.

We have established a team tasked with creating a return-to-office plan to ensure staff safety and business continuity for the transition back to our offices and facilities. We intend to adopt several new work arrangement models to facilitate, where appropriate, workplace flexibility and to support our return-to-office plan safely and effectively. In addition to promoting productivity and efficiency, we believe these new work arrangement models will reduce the environmental impact of our business and operations.

Our continued efforts throughout the COVID-19 pandemic have reinforced our commitment to staff safety and serving patients by maintaining business continuity and executing on our commitment to develop transformative therapies for patients with serious diseases, including solid tumors, hematologic cancers and autoimmune diseases. We believe going above and beyond to mitigate the risk of COVID-19 to on-site staff and other stakeholders exemplifies our TRAIT values.

TRAIT Values and Diversity

We have formalized a set of corporate values to guide us in how we conduct our business and execute our corporate strategy.

16

Consistent with our TRAIT values, we believe a diverse and inclusive culture supports our ability to serve patients. We encourage all of our employees to participate in our diversity, inclusion and belonging initiatives to strengthen and grow our diverse and inclusive culture, which include educational webinars, cultural engagement events, fireside chats and a robust set of diversity, inclusion and belonging courses available through LinkedIn Learning. We also have an employee resource group, the Atara Women’s Alliance, the mission of which is to strengthen the leadership, voices and impact of women and to create an inclusive environment where diverse viewpoints and backgrounds are valued. In addition, our Board meets the current diversity requirements specified under California law and it is our expectation we will continue to meet such requirements in future periods.

Employee Engagement

We conduct employee feedback surveys on a regular basis that are designed to help us measure overall employee engagement. These surveys help us assess our culture and the feedback helps us in building a great company to work for and provides important insight into the areas we may need to focus on. The surveys will continue to be leveraged to support measuring our progress on the Company’s important initiatives and adherence to our TRAIT values.

17

Advisory Vote on Executive Compensation

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), and Section 14A of the Exchange Act, the Company’s stockholders are entitled to vote to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement in accordance with SEC rules.

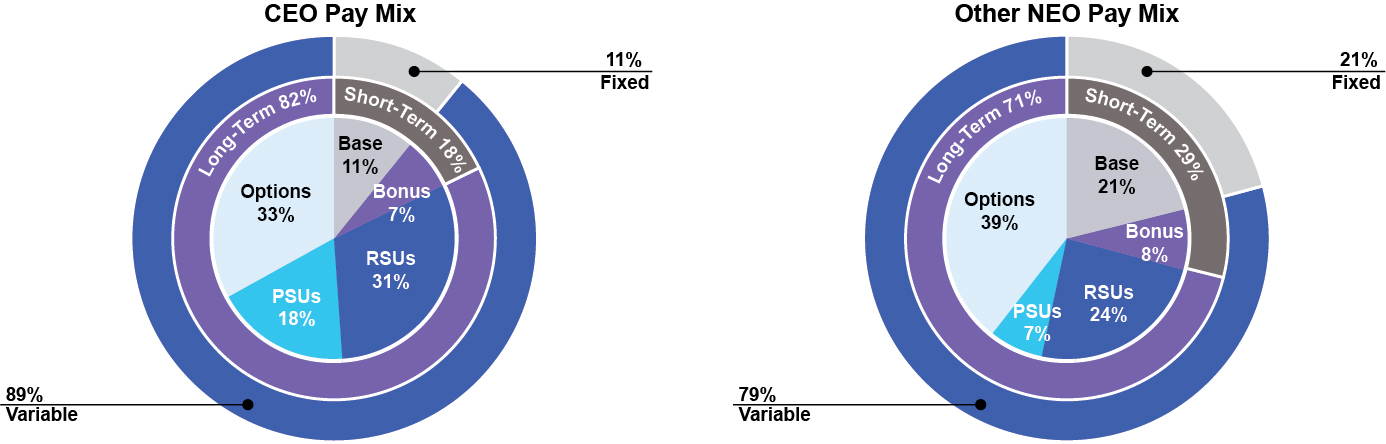

This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in this Proxy Statement. The compensation of the Company’s named executive officers subject to the vote is disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative disclosure contained in this Proxy Statement. As discussed in those disclosures, the Company believes that its compensation policies and decisions are designed to meet two objectives: (i) to attract and retain talented and skilled executives by paying for performance; and (ii) to align compensation of our executives with our stockholders through an appropriate mix of short-term and long-term compensation. Compensation of the Company’s named executive officers is designed to enable the Company to attract and retain talented and experienced executives to lead the Company successfully in a competitive environment.

Accordingly, the Board is asking the stockholders to indicate their support for the compensation of the Company’s named executive officers as described in this Proxy Statement by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion that accompanies the compensation tables, is hereby APPROVED.”

Because the vote is advisory, it is not binding on the Board or the Company. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to the Board and the Compensation Committee, and accordingly the Board and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the vote of the holders of a majority of the shares present in person, present by remote communications, if applicable, or represented by proxy and entitled to vote on the matter at the annual meeting. Unless the Board decides to modify its policy regarding the frequency of soliciting advisory votes on the compensation of the Company’s named executives, the next scheduled say-on-pay vote will be at the 2022 Annual Meeting of Stockholders.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 2

18

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Deloitte & Touche LLP (“Deloitte & Touche”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Deloitte & Touche has audited our financial statements since our inception in 2012. Representatives of Deloitte & Touche are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.