Exhibit 99.1

Atara Bio Announces Fourth Quarter and Full Year 2016 Financial Results and Recent Highlights

SOUTH SAN FRANCISCO, Calif., March 9, 2017 (GLOBE NEWSWIRE) -- Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a biopharmaceutical company developing meaningful therapies for patients with severe and life-threatening diseases that have been underserved by scientific innovation, today reported financial results for the fourth quarter and full year ended December 31, 2016 and recent operational highlights.

"We believe 2017 will be a transformative year for Atara Bio as we continue to advance our robust pipeline of allogeneic T-cell therapies to address multiple diseases with high unmet medical need,” said Isaac Ciechanover, Chief Executive Officer and President of Atara Bio. “In December of last year, we reached agreement with the FDA on the designs of two separate Phase 3 trials of ATA129 in the treatment of EBV-PTLD, and more recently we announced EMA support for our plan to submit a conditional marketing authorization application for potential approval of ATA129 in the EU.”

Recent Highlights and Anticipated Upcoming Milestones

|

• |

Reached agreement with the U.S. Food and Drug Administration (FDA) on the design of two Phase 3 trials for ATA129 intended to support approval in the treatment of rituximab-refractory Epstein-Barr Virus (EBV)-Associated Post Transplant Lymphoproliferative Disorder (EBV-PTLD) after hematopoietic cell transplant (HCT) or solid organ transplant (SOT). |

|

|

o |

The MATCH trial (EBV-PTLD after HCT) is a multicenter, open label, single arm trial designed to enroll approximately 35 patients previously treated with rituximab. |

|

|

o |

The ALLELE trial (EBV-PTLD after SOT) is a multicenter, open label trial designed to enroll patients concurrently in two non-comparative cohorts. The first cohort will include approximately 35 patients who previously received rituximab monotherapy; the second cohort will include approximately 35 patients who previously received rituximab plus chemotherapy. |

|

|

o |

The primary endpoint of both the MATCH and ALLELE trials is objective response rate, defined as the percent of patients achieving either a complete or partial response to treatment with ATA129. |

|

• |

Generated and evaluated data from lots of ATA129 manufactured by the Company’s contract manufacturing organization and initiated discussions with FDA. The Company has been successful in producing ATA129 drug product and identified certain assays that need refinement prior to initiating the Phase 3 trials. Atara is refining these assays within its laboratories, manufacturing lots to further support comparability evaluations and the Phase 3 trials, and expects to review these data in ongoing discussions with the FDA. |

|

• |

Announced plans to submit in 2018 an application for Conditional Marketing Authorization (CMA) to the European Medicines Agency (EMA) for ATA129 in the treatment of patients with rituximab refractory EBV-PTLD following HCT. |

|

|

o |

The CMA will be based on clinical data from Phase 1 and 2 trials conducted at MSK and supported by available data from the Company's Phase 3 MATCH and ALLELE trials, which will be ongoing at the time of filing. |

|

• |

Announced that access was granted by the EMA's recently established Priority Medicines (PRIME) regulatory initiative for ATA129 in the treatment of patients with rituximab refractory EBV-PTLD following HCT. |

|

• |

Broadened ongoing expanded access protocol (EAP) trial for ATA129 to include other EBV-positive malignancies such as Diffuse large B-cell lymphoma, Hodgkin lymphoma, Burkitt lymphoma, and nasopharyngeal carcinoma. |

|

|

o |

Plan to initiate a Phase 1 trial of ATA188 in MS in the second half of 2017. |

|

• |

Signed a lease for an approximately 90,000 square foot facility in Thousand Oaks, CA and plan to build-out a multi-product cellular therapy manufacturing facility with manufacturing operations expected to commence in 2018. |

|

• |

Reported additional efficacy and safety data from the Company's ongoing Phase 2 trial of ATA230, cytomegalovirus (CMV)-targeted cytotoxic T lymphocytes (CMV-CTLs), in the treatment of patients with refractory CMV infections that occur following HCT during the American Society of Hematology (ASH) Annual Meeting in December 2016. |

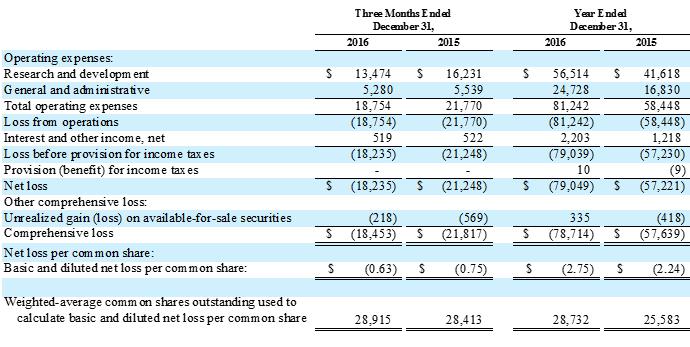

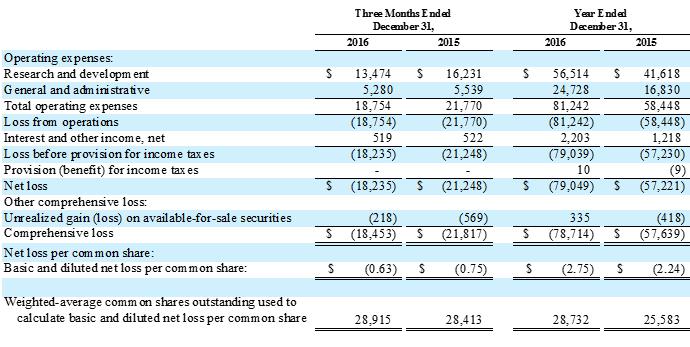

Fourth Quarter and Full Year 2016 Financial Results

|

• |

Cash and investments as of December 31, 2016 totaled $255.7 million, which the Company believes will be sufficient to fund its planned operations into the first quarter of 2019. |

|

• |

The Company reported net losses of $18.2 million, or $0.63 per share, and $79.0 million, or $2.75 per share, for the fourth quarter and fiscal year 2016, as compared to $21.2 million, or $0.75 per share, and $57.2 million, or $2.24 per share, for the same periods in 2015. Substantially all of the Company's net losses resulted from research and development expenses related to clinical and preclinical programs and from general and administrative expenses associated with operations. |

|

• |

Total research and development expenses were $13.5 million and $56.5 million for the fourth quarter and fiscal year 2016, as compared to $16.2 million and $41.6 million for the same periods in 2015. The decrease in fourth quarter expenses from the prior period was primarily due to license fees of $3.0 million included in the fourth quarter of 2015. The increase in fiscal 2016 expense was in large part due to preparations for the two Phase 3 clinical trials in EBV-PTLD and the initiation of our EAP clinical trial, as well as an increase in manufacturing activities related to the technical transfer of ATA129 manufacturing to a third party CMO. Research and development expenses include $7.6 million and $4.8 million of non-cash stock-based compensation expenses in fiscal 2016 and 2015, respectively. |

|

• |

General and administrative expenses were $5.3 million and $24.7 million for the fourth quarter and fiscal year 2016, as compared to $5.5 million and $16.8 million for the same periods in 2015. The increase in fiscal year expense in 2016 was primarily due to an increase in compensation-related costs for the additional headcount to support our expanding operations. General and administrative expenses include $9.2 million and $5.4 million of non-cash stock-based compensation expenses in fiscal 2016 and 2015, respectively. |

About Atara Biotherapeutics’ Allogeneic Cellular Therapy Platform

Atara Bio's cellular therapy platform provides healthy immune capability to a patient and arms the immune system to precisely target and combat disease. Cells derived from healthy donors are manufactured in advance and stored as inventory so that a customized unit of cells can be chosen for each patient. The cells are ready to infuse in approximately 3 to 5 days. Once administered, the cells home to their target, expand in-vivo to eliminate diseased cells, and eventually recede. This versatile platform can be directed towards a broad array of disease causing targets and has demonstrated clinical proof of concept across both viral and non-viral targets in conditions ranging from liquid and solid tumors to infectious and autoimmune diseases. The Company has pursued prospective feedback from health authorities on both manufacturing and clinical trial design. Atara Bio’s lead product candidate has the potential to be the first commercial allogeneic T-cell therapy for a viral target implicated in cancer.

About Atara Biotherapeutics, Inc.

Atara Biotherapeutics, Inc. is a biopharmaceutical company developing meaningful therapies for patients with severe and life-threatening diseases that have been underserved by scientific innovation, with an initial focus on allogeneic T-cell therapies for cancer, autoimmune, and infectious disease. Atara Bio's T-cell product candidates harness the power of the immune system to recognize and attack cancer cells and cells infected with certain viruses. The Company's initial clinical stage T-cell product candidates include Epstein-Barr virus targeted Cytotoxic T-cells (EBV-CTL), or ATA129, Cytomegalovirus targeted Cytotoxic T-cells (CMV-CTL), or ATA230, and Wilms Tumor 1 targeted Cytotoxic T-cells (WT1-CTL), or ATA520. These product candidates have demonstrated the potential to have therapeutic benefit in a number of clinical indications including hematologic malignancies, solid tumors, and refractory viral infections. The Company is also developing a next generation of allogeneic T-cell product candidates utilizing a technology to selectively enhance a T-cell's ability to target specific viral proteins implicated in disease. Initial clinical investigations employing this approach will focus on multiple sclerosis and other virally mediated cancers and infections.

Forward-Looking Statements

This press release contains or may imply "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For example, forward-looking statements include statements regarding: the Company’s belief that 2017 will be a transformative year for Atara Bio; the Company’s plan to submit a conditional marketing authorization application for potential approval of ATA129 in the EU; the Company’s belief that it has been successful in producing ATA129 drug product; the Company’s refinement of certain assays, manufacture of lots to further support comparability evaluations and the Phase 3 trials, and expectations to review these data with FDA prior to starting these trials; plans for the CMA to be based on clinical data from Phase 1 and 2 trials conducted at MSK and supported by available data from the Company's Phase 3 MATCH and ALLELE trials, which will be ongoing at the time of filing; the Company’s expectation that its collaborating investigators will present at a medical conference in 2017 initial data from a Phase 1 trial of the autologous version of ATA188 in patients with primary and secondary progressive MS; the Company’s plan to initiate a Phase 1 trial of ATA188 in MS in the second half of 2017; the Company’s plan to build-out a multi-product cellular therapy manufacturing facility with manufacturing operations expected to commence in 2018; and the Company’s belief that its cash and investments as of December 31, 2016 will be sufficient to fund its planned operations into the first quarter of 2019. Because such statements deal with future events and are based on Atara Bio's current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of Atara Bio could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including those discussed under the heading "Risk Factors" in Atara Bio's quarterly report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on November 4, 2016, including the documents incorporated by reference therein, and subsequent filings with the SEC. Except as otherwise required by law, Atara Bio disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events or circumstances or otherwise.

Atara Biotherapeutics, Inc.

(Unaudited)

(In thousands)

|

|

|

December 31, |

|

|

December 31, |

|

||

|

|

|

2016 |

|

|

2015 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

47,968 |

|

|

$ |

23,746 |

|

|

Short-term investments |

|

|

207,714 |

|

|

|

296,736 |

|

|

Restricted cash |

|

|

194 |

|

|

|

194 |

|

|

Prepaid expenses and other current assets |

|

|

4,677 |

|

|

|

3,921 |

|

|

Total current assets |

|

|

260,553 |

|

|

|

324,597 |

|

|

Property and equipment, net |

|

|

3,259 |

|

|

|

270 |

|

|

Other assets |

|

|

102 |

|

|

|

108 |

|

|

Total assets |

|

$ |

263,914 |

|

|

$ |

324,975 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,778 |

|

|

$ |

1,445 |

|

|

Accrued compensation |

|

|

3,745 |

|

|

|

2,624 |

|

|

Accrued research and development expenses |

|

|

2,408 |

|

|

|

5,112 |

|

|

Other accrued liabilities |

|

|

744 |

|

|

|

528 |

|

|

Total current liabilities |

|

|

9,675 |

|

|

|

9,709 |

|

|

Long-term liabilities |

|

|

503 |

|

|

|

166 |

|

|

Total liabilities |

|

|

10,178 |

|

|

|

9,875 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

3 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

|

431,075 |

|

|

|

413,725 |

|

|

Accumulated other comprehensive loss |

|

|

(183 |

) |

|

|

(518 |

) |

|

Accumulated deficit |

|

|

(177,159 |

) |

|

|

(98,110 |

) |

|

Total stockholders’ equity |

|

|

253,736 |

|

|

|

315,100 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

263,914 |

|

|

$ |

324,975 |

|

Atara Biotherapeutics, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except per share amounts)

INVESTOR & MEDIA CONTACTS:

Investors:

Steve Klass, Burns McClellan on behalf of Atara Bio

212-213-0006 x331

sklass@burnsmc.com

Media:

Justin Jackson, Burns McClellan

212-213-0006 x327

jjackson@burnsmc.com